What to Do with America’s Dying Malls

The American mall was born out of President Eisenhower’s Federal-Aid Highway Act, which allowed people to drive to their jobs in cities while living in the new suburbs of the 1950s. While suburban population centers grew exponentially in the 1950s and 1960s, these new towns lacked the proper retail outlets to support their burgeoning populations.

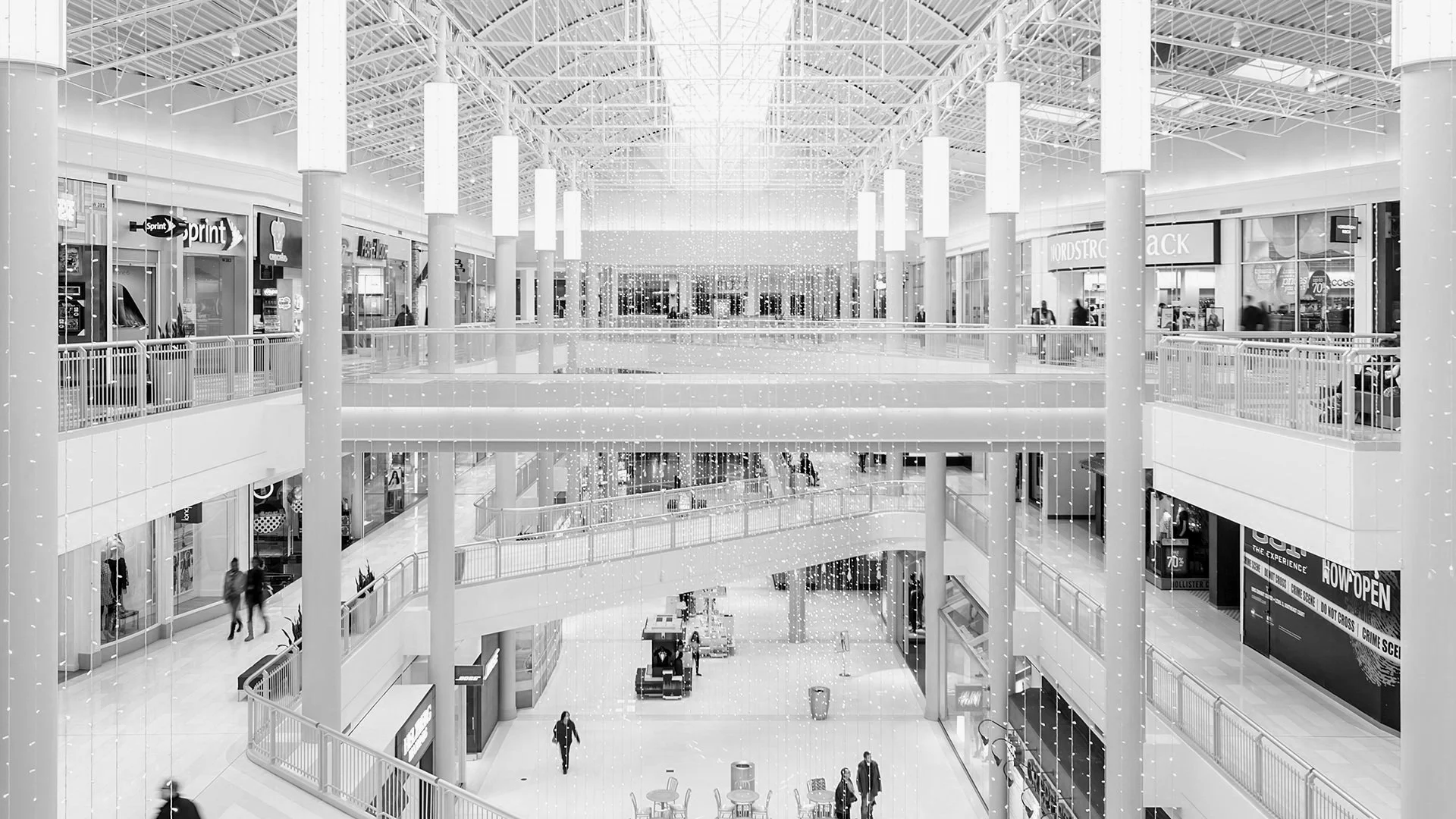

Enter the American mall. By 1975 malls and shopping centers made up 33% of all retail sales in the United States. The mall reached its apex in the early 1990s with the advent of the mega-mall. Structures like the Mall of America outside of Minneapolis, offered consumers the opportunity to shop at one of its more than 500 stores.

The picture looks very different today. With the advent of e-commerce and websites like Amazon and Jet.com, consumers can now purchase almost any product in seconds at their computer and have it delivered to their front-door in one or two days for a nominal, if any, cost. According to Green Street Advisors, by the end of 2021 more than half of all mall-based department stores will shut their doors. Department stores account for approximately one out of every three square feet in all malls.

The picture for malls was already dire before the Covid-19 pandemic. Like many changes in the world that the pandemic has accelerated, the advent of e-commerce shopping is one of them. More than 1/3 of all U.S. malls are expected to close-down by the end of 2021, this initially was not expected to happen until 2030 according to retail consultant Jan Kniffen.

The challenge, and opportunity, now is what to do with all of these buildings and land. The market has spoken and it is clear that for many malls in the U.S., particularly B and C Class malls, their highest and best use are no longer as a retail mega-centers.

Malls have the advantage for multifamily developers of already having a retail component built into them. Shopping-centers are also usually centrally located and near main transit-nodes, making them desirable locations to live. About 60 malls have already been reconstructed as housing in the U.S. with approximately another 75 developments being planned.

A good example of this is the repurposing of Lakewood, Colorado’s indoor mall. The local Lakewood economy became extremely distressed when its local mall failed in 2000. At the time, Lakewood did not have a lively downtown shopping area, and the local mall was the city’s primary economic driver. Along with private developers, the municipality of Lakewood replaced its mall with a 20-plus block walkable downtown area. This development included about 300,000 square feet of office space, multifamily housing for 2,000 residents, and nine acres of parks. The result of this development has been rising residential housing prices in the once struggling area. This project has brought so much new investment to Lakewood, that local residents recently voted to put a cap on new multifamily developments. A problem most municipalities wish they had.

One of the primary challenges to repurposing antiquated retail structures is local bureaucracy. Most malls were built in areas zoned exclusively for retail use. To repurpose almost any mall, a developer must go before the local planning agency to re-zone the area for mixed-use development. Another barrier many developers face when trying to convert malls into mixed-use or residential communities are environmental reviews that can take up to half-a-decade in some instances. That is why it is imperative for any developer who is considering repurposing a mall or shopping-center into a residential or mixed-use project, to make sure that before they enter into contract on a property, that the local government will be supportive of their redevelopment efforts.

Another way malls may be repurposed is as distribution centers. The irony cannot be lost that the companies that are putting malls out of business, e-commerce operations, are buying and leasing up vacant retail space to support their continued crusade to disrupt the retail industry. Between 2016-2019 Amazon converted approximately 25 malls into logistics centers. Malls, built close to population centers, provide e-commerce outlets with ample space to store their inventory in strategic locations close to many urban and suburban hubs.

An example of this is the former Cortana Mall in Baton Rouge, Louisiana. Amazon was able to buy the Cortana Mall for only $6 per square foot in addition to receiving a $35 Million local tax abatement. While the project has received a degree of local opposition, Amazon will be creating 1,000 new jobs as part of the project. While all parties will never be happy with these types of transactions, repurposing malls as distribution facilities is a way to create new jobs and generate local tax revenue in areas that would have otherwise had an empty mall collecting dust.

E-commerce will continue to become more pervasive in our society. It will continue to dictate how and where consumers spend their discretionary income in the coming years. While some malls, particularly the strongest Class A malls in gateway markets, may do well, on the aggregate American malls will continue to struggle over the coming decade.

Proactive local governments, who are willing to work in concert with developers to repurpose antiquated retail space into new and exciting projects will be rewarded. This will give municipalities a chance to create new housing, shopping, and jobs that are positioned to succeed in today’s dynamic economy.